Posted by Todd Burner – Developer Relations Engineer

Cybercriminals proceed to put money into superior monetary fraud scams, costing shoppers greater than $1 trillion in losses. In response to the 2023 International State of Scams Report by the International Anti-Rip-off Alliance, 78 p.c of cellular customers surveyed skilled at the very least one rip-off within the final yr. Of these surveyed, 45 p.c stated they’re experiencing extra scams within the final 12 months.

The International Rip-off Report additionally discovered that telephone calls are the highest technique to provoke a rip-off. Scammers often make use of social engineering techniques to deceive cellular customers.

The important thing place these scammers need people to take motion are within the instruments that give entry to their cash. This implies monetary providers are often focused. As cybercriminals push ahead with extra scams, and their attain extends globally, it’s essential to innovate within the response.

One such innovator is Monzo, who’ve been in a position to sort out rip-off calls by a singular impersonation detection function of their app.

Monzo’s Revolutionary Strategy

Based in 2015, Monzo is the biggest digital financial institution within the UK with presence within the US as properly. Their mission is to earn a living work for everybody with an ambition to develop into the one app clients flip to to handle their complete monetary lives.

Impersonation fraud is a matter that the whole {industry} is grappling with and Monzo determined to take motion and introduce an industry-first instrument. An impersonation rip-off is a quite common social engineering tactic when a legal pretends to be another person to allow them to encourage you to ship them cash. These scams typically contain utilizing pressing pretenses that contain a threat to a person’s funds or a possibility for fast wealth. With this strain, fraudsters persuade customers to disable safety safeguards and ignore proactive warnings for potential malware, scams, and phishing.

Name Standing Characteristic

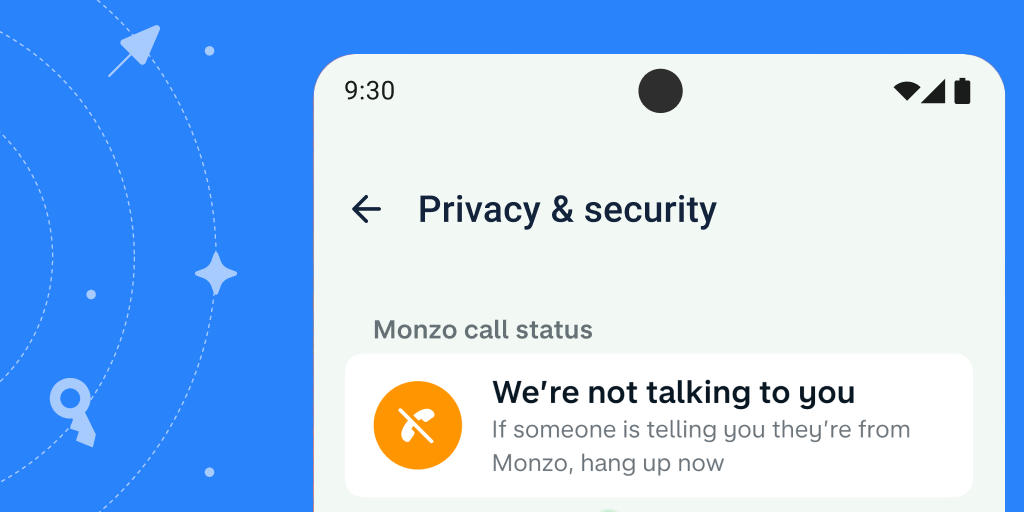

Android gives a number of layers of spam and phishing safety for customers together with name ID and spam safety within the Telephone by Google app. Monzo’s workforce needed to boost that safety by leveraging their in-house phone methods. By integrating with their cellular utility infrastructure they might assist their clients affirm in actual time after they’re really speaking to a member of Monzo’s buyer help workforce in a privateness preserving method.

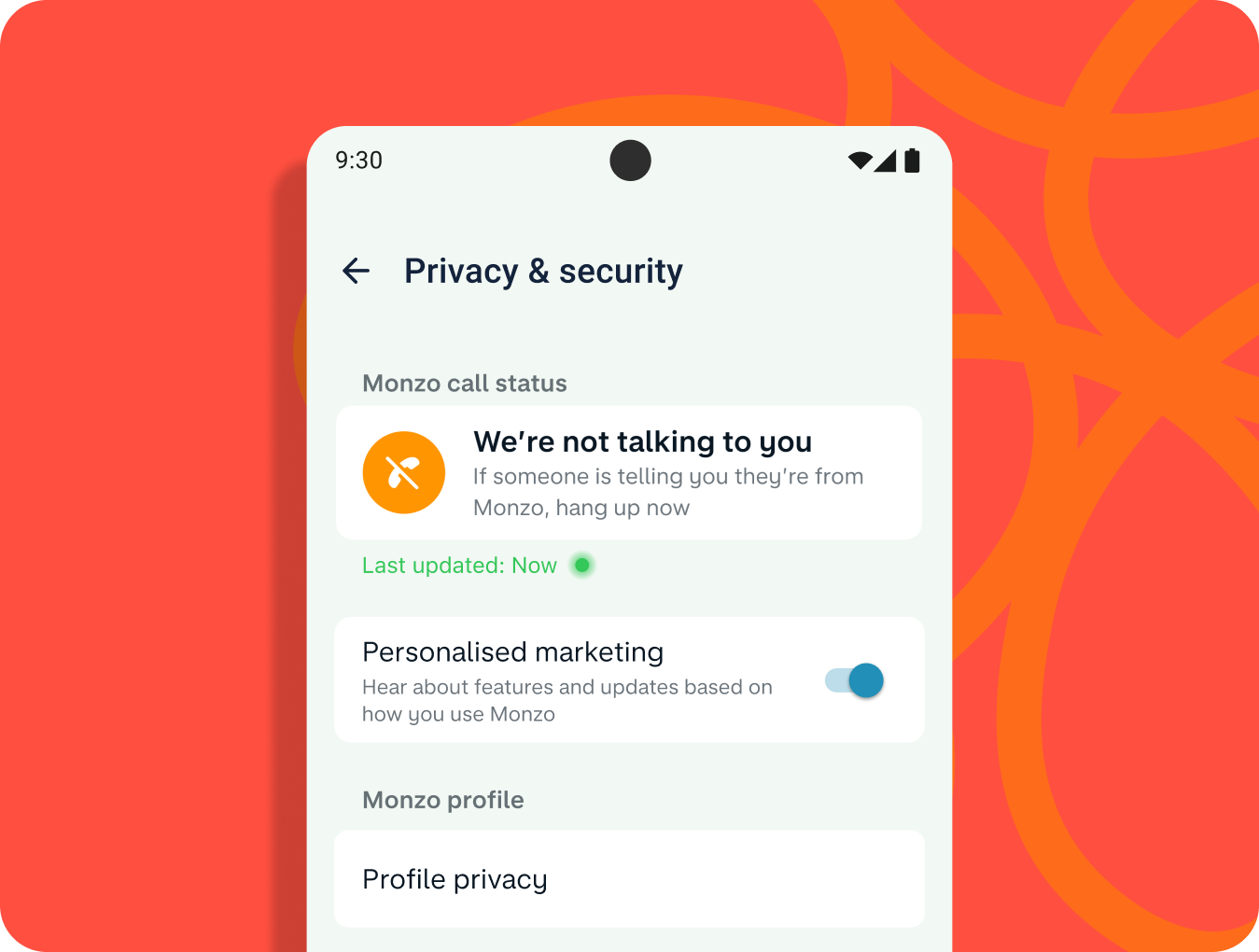

If somebody calls a Monzo buyer stating they’re from the financial institution, their customers can go into the app to confirm this. Within the Monzo app’s Privateness & Safety part, customers can see the ‘Monzo Name Standing’, letting them know if there’s an lively name ongoing with an precise Monzo workforce member.

“We’ve constructed this industry-first function utilizing our world-class tech to supply a further layer of consolation and safety. Our hope is that this might cease cases of impersonation scams for Monzo clients from taking place within the first place and impacting clients.”

– Priyesh Patel, Senior Workers Engineer, Monzo’s Safety workforce

Retaining Prospects Knowledgeable

If a person isn’t speaking to a member of Monzo’s buyer help workforce they are going to see that in addition to some useful info. If the ‘Monzo name standing’ is displaying that you’re not chatting with Monzo, the decision standing function tells you to hold up instantly and report it to their workforce. Their clients can begin a rip-off report straight from the decision standing function within the app.

If a real name is ongoing the shopper will see the data.

How does it work?

Monzo has built-in a couple of methods collectively to assist inform their clients. A cross useful workforce was put collectively to construct an answer.

Monzo’s in-house expertise stack meant that the methods that energy their app and customer support telephone calls can simply talk with each other. This allowed them to hyperlink the 2 and share particulars of customer support calls with their app, precisely and in real-time.

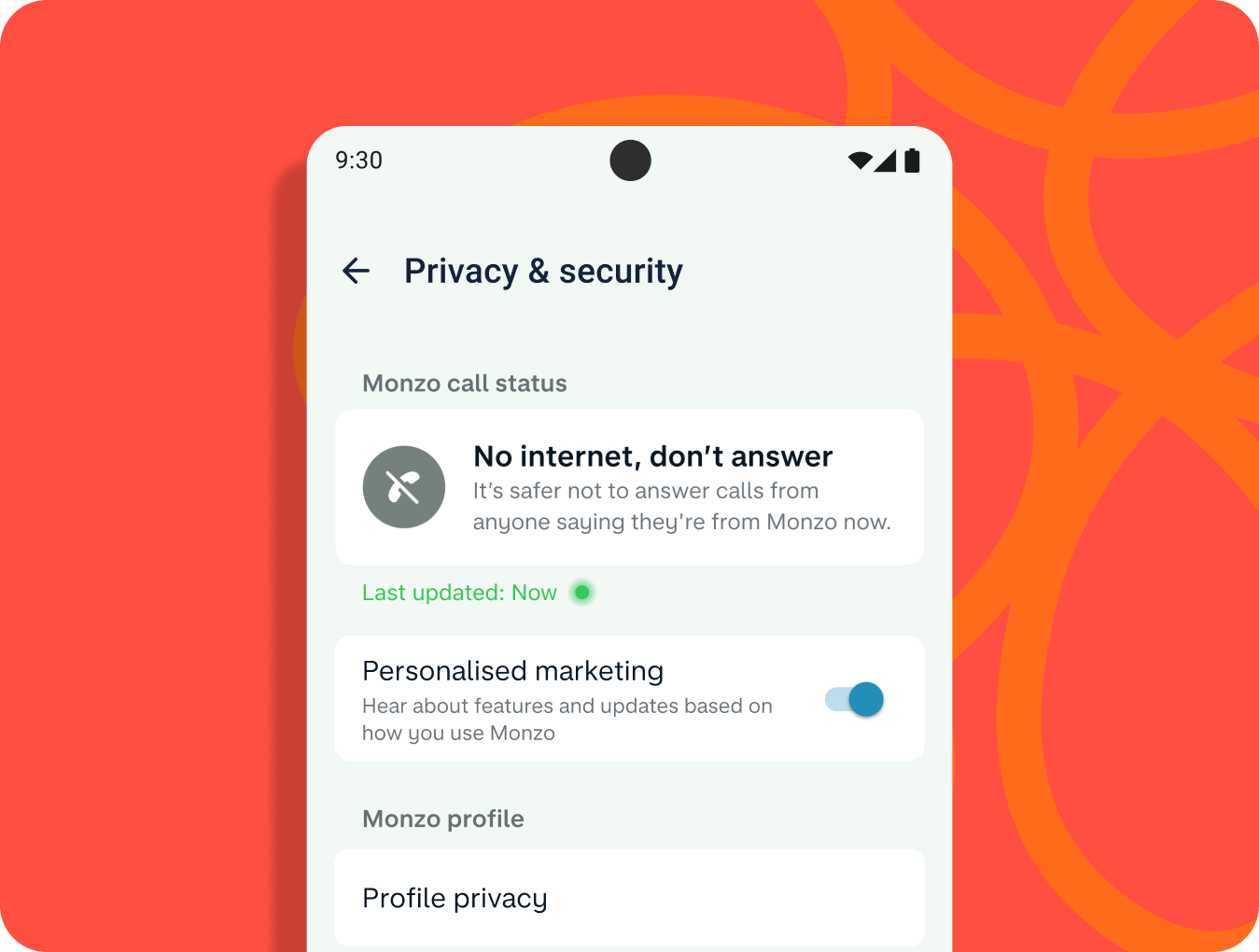

The workforce then labored to establish edge instances, like when the person is offline. On this state of affairs Monzo recommends that clients don’t converse to anybody claiming they’re from Monzo till you’re related to the web once more and may test the decision standing throughout the app.

Outcomes and Subsequent Steps

The function has confirmed extremely efficient in safeguarding clients, and obtained common reward from {industry} consultants and shopper champions.

“Since we launched Name Standing, we obtain a mean of round 700 reviews of suspected fraud from our clients by the function per thirty days.

Now that it’s reside and serving to defend clients, we’re at all times on the lookout for methods to enhance Name Standing – like making it extra seen and simpler to seek out for those who’re on a name and also you wish to shortly test that who you’re chatting with is who they are saying they’re.”– Priyesh Patel, Senior Workers Engineer, Monzo’s Safety workforce

Last Recommendation

Monzo continues to speculate and innovate in fraud prevention. The decision standing function brings collectively each technological innovation and buyer training to attain its success, and provides their clients a option to catch scammers in motion.

A layered safety method is an effective way to guard customers. Android and Google Play present layers like app sandboxing, Google Play Defend, and privateness preserving permissions, and Monzo has constructed a further one in a privacy-preserving method.

To be taught extra about Android and Play’s protections and to additional defend your app take a look at these assets:

Leave a Comment